By Paul-Henri Matha

Axel Maschka is the executive vice president at Mobis. He graciously shared his thoughts with me:

DVN: Axel, what is your vision about the automotive market?

Axel Maschka: The vision for the global automotive market focuses on sustainability and innovation. In line with this, global players will introduce various technologies and strategies for the future of mobility. Software-defined vehicles, eco-friendly cars, and fully autonomous driving technologies are key elements of the future mobility market. Major players in each region are driving change, and these innovations and sustainability efforts aim to provide consumers with a better environment and improved quality of life—this is the ultimate goal of the automotive market and its players.

However, from my perspective, there are still obstacles with the rollout of electric and autonomous vehicles. In the case of autonomous driving, while advancements from L2 to L3 and beyond are progressing, there are signs of technical stagnation, and consumers face financial burdens with the adoption of new technologies. To address this, the market needs to grow through affordable solutions such as L2 and L2+, paving the way for the adoption of higher-level technologies at a later stage.

For EVs, the lack of charging infrastructure remains a significant hurdle. Expanding the infrastructure is critical to easing consumer concerns and accelerating market growth.

The essence of the market lies with the consumers preferences. Automotive players must address these inconveniences and challenges. The player who excels in resolving these issues will ultimately lead the market.

DVN: What does Mobis’ lighting strategy look like?

A.M.: Currently, Mobis is responding to global OEMs with five factories, six sales offices, and five R&D centres around the world. Mobis supplies lamps to a variety of OEMs not only in Asia but also in Europe and North America, maintaining strong business relationships with them. Moving forward, we will continue to strive to expand Mobis’ presence in the global market.

DVN: How will you remain competitive within the new automotive landscape?

A.M.: Mobis handles lamp development and manufacturing, encompassing design (styling), engineering, production, quality control, and testing—that is our strong point. Additionally, since Mobis has peripheral lighting-related business, such as ADAS sensors and bumpers, we can create synergies in developing new lamp technologies, especially as functional integrated lamps become more prevalent.

Furthermore, Mobis has developed technologies that achieve both cost-effectiveness and cutting-edge innovation, such as the uniform-emitting MCL (micro cylindrical lens) headlamp, which reduces costs by more than 30 per cent compared to MLA and was previously introduced at DVN, and the DLED (direct-diffused LED) rear lamp, a homogeneous lamp integrating tail and stop functions in one area. We will continue to stay ahead of rapidly evolving technology trends by advancing swift and innovative development.

DVN: What about exterior display trends? What do you think of the various technologies being used in them, and will they expand beyond China?

A.M.: While it is challenging at this moment, in the medium to long term, I believe head and rear lamps will increasingly be developed into display forms for information transmission—such as pixel lighting, thanks to the advancements of microLED and miniLED technology. To consider price competitiveness, Mobis is focusing on the development of 3D front grille lamp using our proprietary lenticular technology, rather than miniLEDs.

DVN: Projection systems already exist in Korea for reversing lamps. What is the Mobis strategy, and what technology do you favour?

A.M.: Many tier-1 suppliers are currently developing products using technologies such as gobo, MLA, DLP, and MEMS. Mobis is already mass-producing gobo-type products, and has achieved optimization and miniaturization of projection images with projection optics in reverse guide lamps. Additionally, Mobis has completed the development of technologies for MLA and DLP, and we plan to develop additional content and technologies to differentiate ourselves from other tier-1 suppliers.

Regarding Signal Road Projection, GTB has been making significant efforts toward regulation formulation, but it will take some time for the regulations to be established. Demand from manufacturers for road projection functionality is expected to increase in the future, and Mobis is prepared to provide the technology and products in line with regulatory developments at any time.

DVN: How do you foresee the prevalence trend of ADB?

A.M.: According to the 2023 DVN report, the market share of ADB is expected to reach 20 per cent by 2028 and 27 per cent by 2030. According to the 2023 IHS Market Research data, systems with more than 500 segments are projected to increase by 6.7 times in 2028 compared to 2023. ADB systems with over 25.6 kilopixels have already been mass-produced in the market, and the adoption of HD microLED technology is also expected to significantly increase.

Since ADB has been legalized in the United States, it is anticipated that the application of ADB headlamps in North American-brand vehicles will rise considerably in the future.

In South Korea, ADB functionality is less activated compared to the U.S. or Europe because of urban roads, which are well-lit with numerous streetlights and vehicles. However, when driving in rural or less populated areas with fewer streetlights, ADB significantly enhances visibility and contributes to safety. The Korean automotive market is highly sensitive to trends, and shows an increasing demand for the application of new technologies, such as safety and convenience features, in new vehicle models.

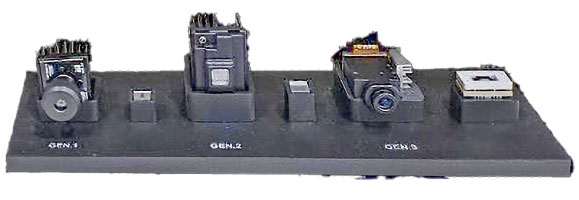

As customer demand and awareness of ADB increases, Mobis has successfully developed the second generation AADB (advanced ADB using ADAS sensor integration for better performance), an upgraded version of the 1st generation AADB initially applied on the Genesis G80.

With the development and mass production of high-segment ADB systems and our AADB systems, which enable precise control, it is expected that drivers will experience greater benefits and come to view ADB as an essential feature.

DVN: Speaking of ADAS, what are your thoughts? Cameras for visible light, IR, and thermal imaging; lidar, 4D radar…which ones will win the race for L3?

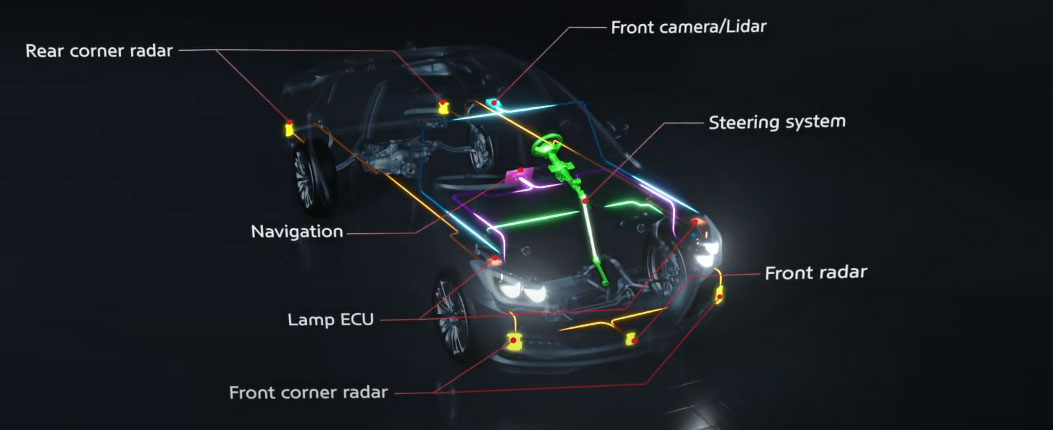

A.M.: For L2 to L2++, Mobis is developing ADAS features based on conventional sensors such as front view cameras, front radar, and corner radar. Additionally, we are expanding functions to meet new regulations (such as low-light AEB). Nobody can anticipate when L3 market will win broad acceptance. Regulations and insurance issues will play a role, and we are preparing technical solution for future L3 systems. We are considering the establishment of a redundant system using lidar, thermal cameras, and 4D radar, which can guarantee detection performance and operation even in harsh environments like severe weather, snow, or low light.

Current sensors like radar typically transmit tracking information of objects. A front view camera transmits image-based recognition and classification data. Based on these, most of companies and systems perform a high-level fusion of the detection results. In the future, I believe that companies developing low-level sensor fusion with AI- based object detection will be able to take the lead in the market.

At the sensor level, we are reviewing various vision recognition solutions that can be supplied for different regions and various vehicle segments. To support systems beyond L3 in the future, we are also considering sensors such as 4D radar, lidar, and thermal cameras. We are developing an integrated controller, the ADC, to replace existing independent controllers for driving and parking. However, the core of our activities is concentrating on the development of safe and affordable L2++ systems based on the highest market demand.

DVN: What sensor setup do you like for the new US requirements for AEB (FMVSS 127)?

A.M.: Under FMVSS 127, by 2029 AEB and FCW must operate at 10 to 145 km/h in low-light conditions. To be configured with a front CMOS camera, but additional sensors such as thermal cameras are being considered for supplemental purposes.